We are talking about an algorithm for assessing credit risk on the part of the borrower..

It is formed from a number of variables.

The rating is compiled based on information about the purchase of goods, open banking information, analysis of professional activities, the presence of loans and debts, etc.

A credit rating makes it easier to analyze the likelihood of bankruptcy of an individual or legal entity.

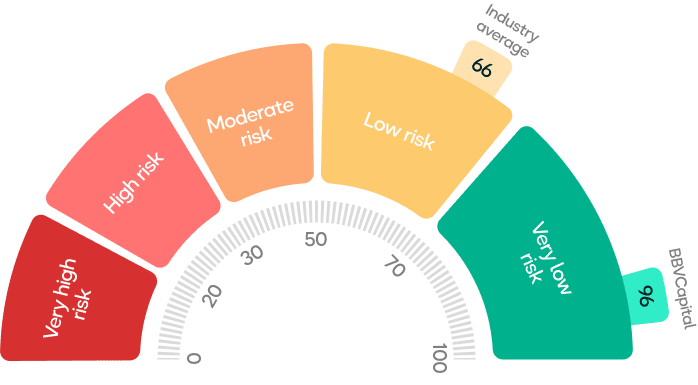

Legal entities and individuals are assessed on a scale from 1 to 100.

The higher the score, the lower the risk that a person or company will face bankruptcy. Conversely, a low score indicates a high probability of failure.

Benefits of trading with E-FXMC

More than 10 years of successful work

Make a choice in favor of a reliable broker working with traders from 100 countries.

Modern platforms

Trade on platforms designed for active stock and CFD traders.

More than 50 IPOs in the last year

For investors, an IPO is an opportunity to earn tens and even hundreds of percent in a short period of time.