Forex Trading

Trade CFDs on 70+ FX pairs and benefit from tight spreads and fast order execution

Registration100,000+

client accounts

With decades of experience, we have earned the trust of millions of traders worldwide, providing reliable online trading services across numerous countries.

20+

awards

Our commitment to excellence has been acknowledged with numerous industry awards for outstanding service and innovation.

5-star

customer service

Our multilingual customer service team is available around the clock on trading days, ensuring traders receive prompt and professional assistance.

5

industry regulations

Operating under top-tier regulatory authorities, we adhere to the highest standards of security and transparency in the financial industry.

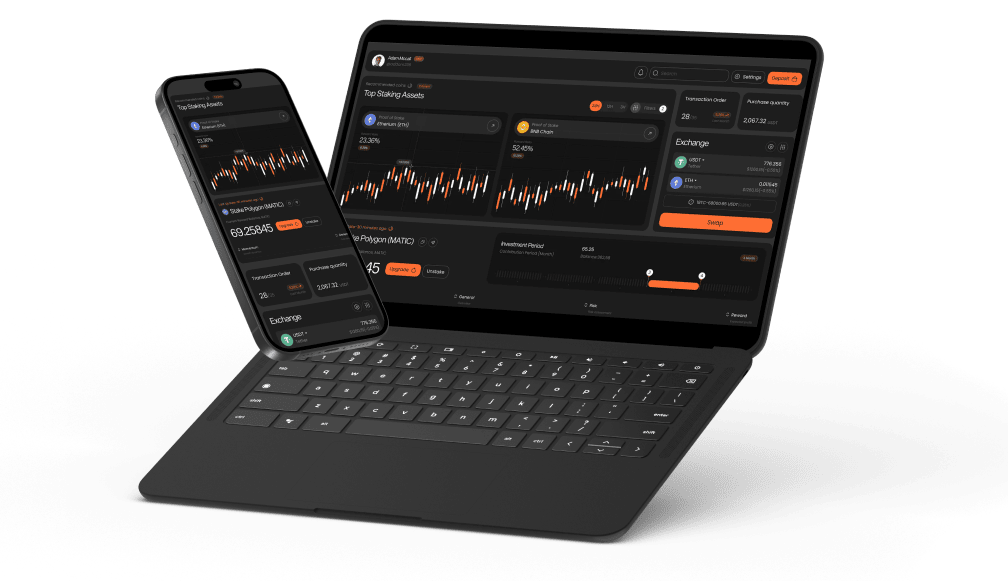

An Advanced

Trading Platform

Trade at your convenience with our versatile platform, available on Windows and Mac OS for desktop, iOS and Android for mobile and tablets, and easily accessible through web browsers with our web app.

Desktop Platform

Customize your trading experience with advanced desktop tools.

Android Trading

Execute trades and manage your portfolio on Android devices.

iOS Trading

Trade on your iPhone or iPad

with real-time data and tools.

Web Trading

Trade easily with our powerful, web-based platform.

Free course for beginners

Get to grips with the basics of trading with our free interactive trading course.

Trading FAQs

Find the answers to common trading questions.

Financial Articles

Informative and detailed articles on various aspects of trading.

Trading Calculators

Estimate your trading costs and required margins with the online calculators.

VPS Guide

Automate your trading with a high-speed, low-latency virtual private server.

Market News

Daily expert reviews from the E-MCFX Analyst Team.

Technical Analysis

Get the latest analysis & trading ideas on thousands of instruments.

Economic calendar

Stay on top of upcoming economic events and the latest data figures.

What is Forex?

The foreign exchange (FX) market comprises various segments, including Spot FX, Futures derivatives, Forward derivatives, and the CFD derivatives market— the latter being the most popular choice among retail traders.

All forex trading transactions combined make up the largest and most liquid financial market, with an average daily volume of over $5 trillion.

The FX CFD derivatives market operates through a network of buyers and sellers, with major international banks serving as the primary participants. These institutions place orders via electronic trading systems in an over-the-counter (OTC) environment, meaning trades are not conducted on a centralized exchange. Instead, each bank provides its own quotes, using the spot market as a reference point for pricing.

It is worth mentioning that the spot FX market is also an OTC market dominated by the large international banks.

In forex trading, spot price of a currency pair is influenced by several factors, such as the economic outlook and geopolitical events in that region, as well as news data releases which may be perceived positively or negatively by the market.

Contracts for difference (CFDs), allow traders to buy (go long) or sell (go short), and make profit or loss from price movements, without having to physically purchase and exchange the underlying currency.

In the FX market, currencies are quoted in pairs, each representing a global currency or economy. The first currency in the pair is known as the "base" currency, which indicates the amount being traded, while the second currency is called the "quote" or "term" currency, representing its value relative to the base currency at the current exchange rate.

For example, the price of EUR/USD represents the amount of $USD that can be exchanged for €1.

EUR/USD = 1.11361

This means that currently, €1 is equal to $1.11361

Prices are constantly fluctuating based on market conditions

To put it simply, traders would go long if they believe that the base currency will rise in value against the term currency and would profit from an increase in price. On the other hand, if traders’ believe that the value of the base currency will fall in relation to the term, they will place a sell trade to try to profit from falling prices. If prices move in the opposite direction to the traders’ forecast, they will make a loss

FX currency trading is typically calculated in Pips, meaning that depending on your trade size, each pip is equal to a specific monetary value of the ‘term’ currency. This pip value is used to determine the PnL (profit or loss), based on how many pips you gain or lose in a trade, and is also used to display spread (the difference between the bid and ask prices)

We quote all FX pairs to an extra digit after the pip, meaning that the last digit in any quote refers to a Point (10% of a Pip).

In FX currency trading, fractional pricing allows us to offer tighter spreads and provide more accurate pricing

If you are new to online forex trading, we would recommend going through our online educational section to familiarise yourself with the market and how ‘Contracts for Difference’ trading works. We also provide ‘watch and learn’ videos and PDF guides.

Trade Like A Pro!

Trade CFDs on a wide range of instruments, including popular FX pairs, Futures, Indices, Metals, Energy and Shares and experience the global markets at your fingertips.

Forex

Trade 70 major, minor & exotic currency pairs with competitive trading conditions.

Metals

Trade metal commodities such as Gold, Silver & Platinum.

Cryptocurrency CFDs

Trade Bitcoin CFD, Ether CFD, Doge CFD & more crypto CFDs & altcoin CFDs.

Indices

Trade major and minor Index CFDs Spot and Futures from around the globe.

Shares

Thousands of public companies from the US, UK & EU available to trade.

Energy

Discover opportunities on UK & US Crude Oil and Natural Gas Spot and Future contracts.

It is easy to start

Join the thousands of traders worldwide that choose to trade with us

Create an Account

Sign up for an account by providing your basic information and completing the registration process.

Fund Your Account

Choose from a variety of convenient payment methods to deposit funds into your trading account.

Start Trading

You can start exploring the markets, executing trades, and taking advantage of trading opportunities.