Stocks

Trade CFDs on thousands of global shares and benefit from ultra-fast order execution.

Registration100,000+

client accounts

With decades of experience, we have earned the trust of millions of traders worldwide, providing reliable online trading services across numerous countries.

20+

awards

Our commitment to excellence has been acknowledged with numerous industry awards for outstanding service and innovation.

5-star

customer service

Our multilingual customer service team is available around the clock on trading days, ensuring traders receive prompt and professional assistance.

5

industry regulations

Operating under top-tier regulatory authorities, we adhere to the highest standards of security and transparency in the financial industry.

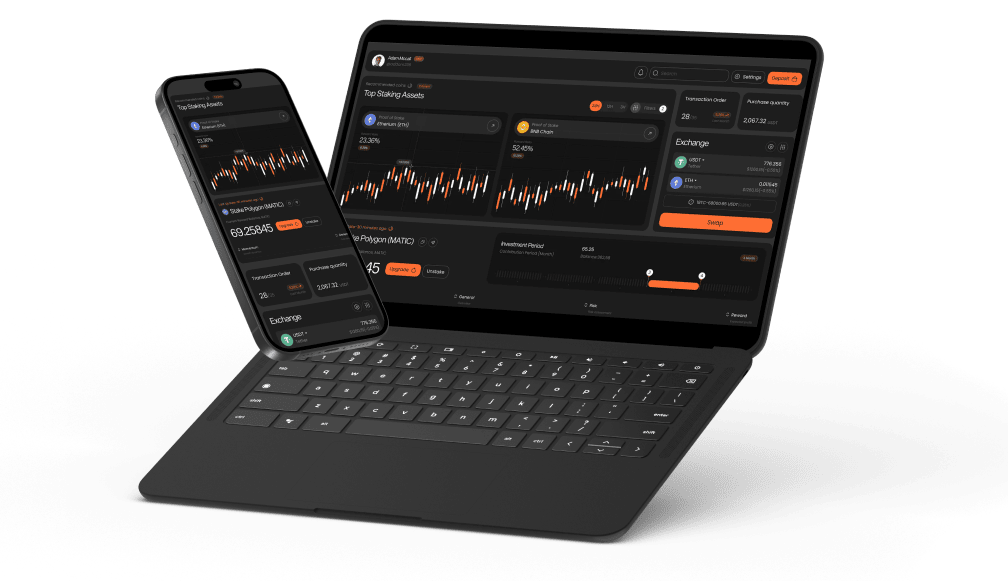

An Advanced

Trading Platform

Trade at your convenience with our versatile platform, available on Windows and Mac OS for desktop, iOS and Android for mobile and tablets, and easily accessible through web browsers with our web app.

Desktop Platform

Customize your trading experience with advanced desktop tools.

Android Trading

Execute trades and manage your portfolio on Android devices.

iOS Trading

Trade on your iPhone or iPad

with real-time data and tools.

Web Trading

Trade easily with our powerful, web-based platform.

Free course for beginners

Get to grips with the basics of trading with our free interactive trading course.

Trading FAQs

Find the answers to common trading questions.

Financial Articles

Informative and detailed articles on various aspects of trading.

Trading Calculators

Estimate your trading costs and required margins with the online calculators.

VPS Guide

Automate your trading with a high-speed, low-latency virtual private server.

Market News

Daily expert reviews from the E-MCFX Analyst Team.

Technical Analysis

Get the latest analysis & trading ideas on thousands of instruments.

Economic calendar

Stay on top of upcoming economic events and the latest data figures.

What Are Shares?

What are CFDs

The CFD market emerged in the early 1990s, primarily to enable traders with limited capital to participate in share trading and benefit from market speculation.

Originally, stock trading required ownership registration of the asset. Over time, to enhance accessibility, Contracts for Difference (CFDs) were introduced, allowing traders to speculate on financial instruments, commodities, and other market assets without direct ownership.

A CFD (Contract for Difference) is a financial instrument that allows traders to buy and sell shares online without owning the underlying asset. Stock trading with CFDs is based on price fluctuations, enabling traders to open "Buy" or "Sell" positions depending on market movements. The contract price is not fixed and continuously changes, reflecting real-time market dynamics.

Trading CFDs on shares enables traders to take both long and short positions, allowing them to benefit from price increases or declines. Since securities reflect corporate actions, traders who go long receive dividend payments, while those who go short incur dividend charges.

Online trading is a widely preferred investment method. We provide CFD trading on shares of some of the world’s most prominent companies, including Apple, Coca-Cola, and Meta.

What you need to know about shares

A share is a financial security that grants an investor partial ownership of a company, along with voting rights on management decisions and the potential to earn profits based on the company’s performance. Shares are generally categorized into two main types.

Ordinary share

Securities grant their owners the right to participate in company management and share in dividend distributions. The highest governing body of an issuing company is the general meeting of shareholders, where decisions are made through voting. Each share represents one vote, meaning an investor holding 1,000 shares has significantly more influence than someone with only 100.

Preferred share

This type of share provides holders with priority in profit distribution. Dividend payments are made to preferred shareholders first, followed by ordinary shareholders. The same priority applies to asset distribution in the event of bankruptcy. However, preferred shareholders typically do not have voting rights at shareholder meetings.

Why do companies issue shares

First of all, that is a tool for raising a company’s capital. These are bought with is put straight into the business for instance into the development of its production or restocking its working capital.

Additionally, being publicly traded enhances a company's reputation, increasing its visibility and transparency. This can attract potential investors looking to trade its shares. However, before a company's securities can be traded on the stock exchange, they must first go through the listing process.

What is a listing

To be included in the stock exchange listing, a company must go through a series of procedures. Each exchange prioritizes investor protection and aims to list only the most stable issuers. To demonstrate the reliability of its securities, a company must meet specific criteria, such as minimum share capital, profitability, and issue size, among other regulatory checks.

Stock price

Each issued share has a nominal value, which is the result of dividing a company’s total authorized capital by the number of shares issued. If a physical certificate is produced, this value is displayed on its front. However, the nominal value does not represent the actual market price of a share during trading, as market dynamics determine its real value.

The issuance value of a security is established once it is listed on the stock exchange. Typically, this value is equal to or slightly higher than the nominal price. However, the market price fluctuates based on corporate performance and investor interest, ultimately shaping the security’s real trading value.

Online trading with CFD

Stock trading begins with research into finding a broker.

In many developed countries, equity investments serve as a key tool for individuals to protect and grow their savings, making them widely accessible. Some investors focus on stable companies with consistent growth and dividend payouts, while others engage in speculation—seeking undervalued stocks to buy low and sell high. Both approaches play a vital role in driving the national economy.

Trade Like A Pro!

Trade CFDs on a wide range of instruments, including popular FX pairs, Futures, Indices, Metals, Energy and Shares and experience the global markets at your fingertips.

Forex

Trade 70 major, minor & exotic currency pairs with competitive trading conditions.

Metals

Trade metal commodities such as Gold, Silver & Platinum.

Cryptocurrency CFDs

Trade Bitcoin CFD, Ether CFD, Doge CFD & more crypto CFDs & altcoin CFDs.

Indices

Trade major and minor Index CFDs Spot and Futures from around the globe.

Shares

Thousands of public companies from the US, UK & EU available to trade.

Energy

Discover opportunities on UK & US Crude Oil and Natural Gas Spot and Future contracts.

It is easy to start

Join the thousands of traders worldwide that choose to trade with us

Create an Account

Sign up for an account by providing your basic information and completing the registration process.

Fund Your Account

Choose from a variety of convenient payment methods to deposit funds into your trading account.

Start Trading

You can start exploring the markets, executing trades, and taking advantage of trading opportunities.